Misclassification often results in lower pay for the worker and could also reduce benefits and protections. If the employer does not treat the individual as an employee, the individual is misclassified and may be owed damages for the non-payment of wages for hours worked. If not, the individual must be considered an employee. If so, the individual is provided a 1099 and required to pay taxes directly. The Borello test determines whether an individual is truly an independent contractor. Independent Contractor – employers do not pay insurance, taxes and other employee benefit costs to independent contractors.Non-exempt – required to receive pay for overtime (typically after 8 hours per day and/or 40 hours per week).Exempt –not qualified to receive overtime pay based on an exception listed in the FLSA (executive, administrative, professional, computer and outside sales).There are several common ways that workers are misclassified as part of the Fair Labor Standards Act (FLSA), which is a federal law that applies to each state and determines the type of pay a worker should receive and how their pay should be calculated.

#EXEMPLE OF PILE DRIVE SCOPE OF WORK HOW TO#

How to Determine Your Prevailing Wage Rate.DIR Frequently Asked Questions on Prevailing Wage.More Resources on Prevailing Wage Classification Northern California Basic Trade Journeyman Rates.Southern California Basic Trade Journeyman Rates.

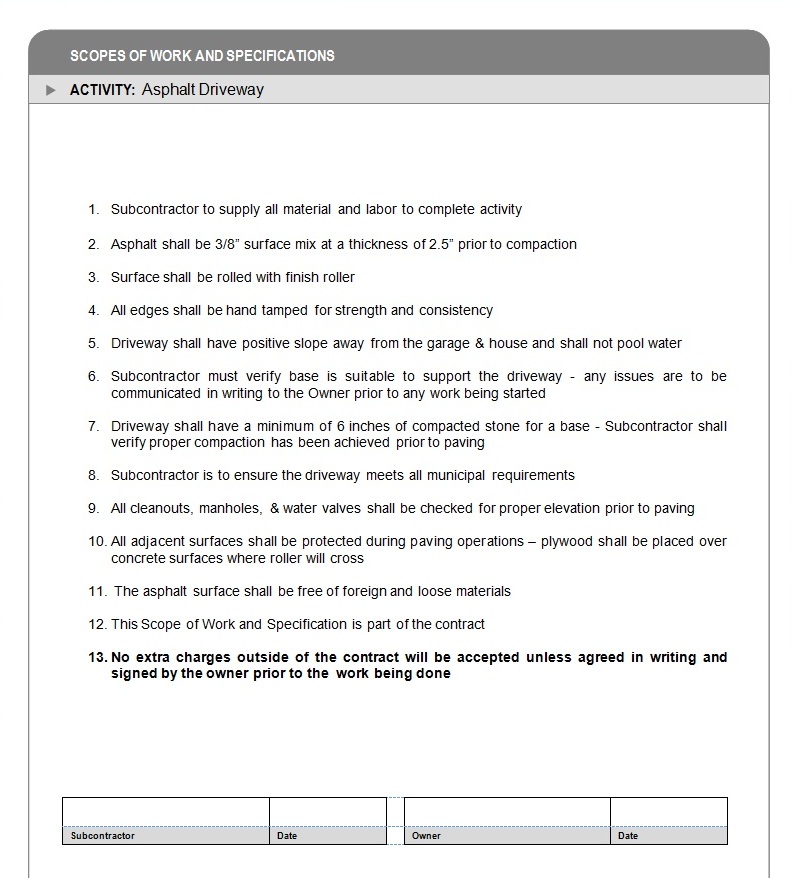

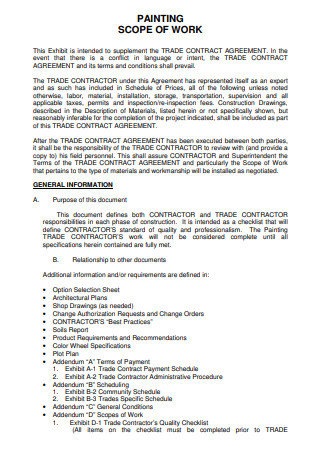

Employers must properly assign the scope of work for each worker on each project.Ĭommon classifications include but are not limited to:Ī complete list of classifications is are available on the DIR web site for: The Director of the Department of Industrial Relations (DIR) defines and approves the scope of work for each classification.

If the employer insists on paying all hours at the lowest wage rate classification there could be a prevailing wage rate violation and back wages owed for prevailing wage work performed and not paid. This means that the hours worked that day must be tallied by classification and paid at the respective rate for each classification. A Cement Mason or Concrete Finisher may also spend time as an Iron Worker setting rebar or a Carpenter when building forms. It is common for a worker to perform work covered by multiple classifications in a single day. However if the worker is operating a piece of equipment covered under the operator classification then the employee must be paid the Operator rate for the time spent as an operator. One of the most common violations of prevailing wage law is misclassification of workers.įor example an employer may classify a worker as a general Laborer instead of an Operator because a Laborer is paid at a lesser rate. Prevailing wage law requires that workers involved in public works projects be paid according to the rates set for their job classification. The classification of work performed is key to determining the proper rate a employee must be paid. Work Classification Determines the Proper Rate The rates for various locations can be found at the links provided at the bottom of this page. Each classification is paid at a rate set by the Department of Industrial Relations (DIR) for the area where the project is located. A worker performing Cabinet Installation would be classified as a Carpenter and paid for the Prevailing Wage rate of a Carpenter. Work performed on Public Works Projects or Prevailing Wage Jobs are subject to various classifications that relate to the actual work performed.įor example when a worker is involved in general cleanup, that would be work of a Laborer Group 1 if a worker is using a Concrete Pile Cutter that would be a Laborer Group 3.

0 kommentar(er)

0 kommentar(er)